Insights

Get Insights And Sound Advice That Combine Technical Expertise With Industry Expertise

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

At GC, our focus is proactive problem-solving, strategic planning, and efficiency to drive heightened profitability. Too often, businesses encounter issues only after they’ve already unfolded,…

Tax time can be overwhelming, particularly with the various documents you need to gather. It is easy to lose track of what is essential. Whether…

GC is always working to keep you informed about new tax law updates, particularly when they affect everyone. All of us receiving a California paycheck are…

Grimbleby Coleman Advisors and Accountants is dedicated to delivering the highest level of service and personal attention, not only as it pertains to advisory, tax,…

If you’re looking for a safe investment that pays a higher interest rate than savings accounts or CDs and is inflation-resistant, Series I savings bonds…

Just in time for the new year — another filing requirement for business owners. Starting January 1, 2024, business owners will be responsible for reporting…

Our Client Accounting Services team is pleased to offer crucial details to help you navigate the upcoming tax year. This 2024 Payroll Summary is a…

In today’s dynamic economic business landscape, harnessing the power of financial data is essential for informed decision-making. Your financial statements are not just a collection…

Grimbleby Coleman’s 2023 Year-End Tax Planning Guide for Businesses is now available! We all make our assessments at the year’s end, but none more so…

The United States is a generous country, with 69% of taxpayers contributing to charities annually, and being philanthropic offers the added benefit of a charitable…

As the year comes to a close, it’s important to think about your financial goals and make sure they align with your current and future…

The Tax team here at Grimbleby Coleman has been keeping an eye on news about the Federal and State Tax deadlines. In a previous update,…

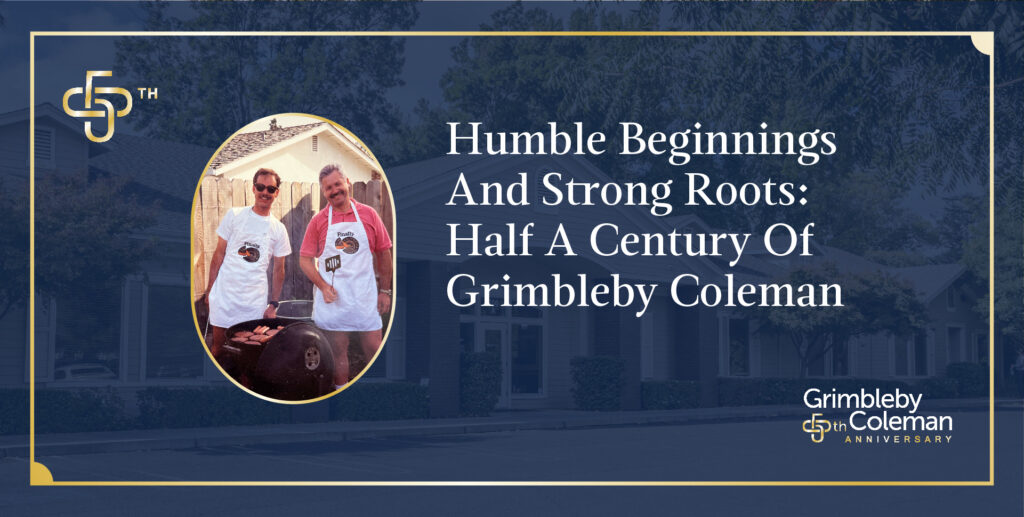

It was 1973. The city of Modesto was growing but still small (only 60K people!). After a long period of post-war prosperity, America was experiencing…

The flooding disaster tax relief in California granted most California taxpayers automatic extensions for filing their 2022 tax returns and paying any taxes due; in…

For months, economists and the media have warned us that efforts to curb inflation could lead to a recession. According to the traditional definition of a…

Grimbleby Coleman’s Audit & Assurance (A&A) Team is expanding in ways that weren’t possible even five years ago. Thanks to our brilliant team, leading-edge technology,…

Our team at Grimbleby Coleman is always on alert for scams of all kinds, as they get more “creative” all the time. A new threat…

Members of the GC Estates & Trusts team are always happy when we have the opportunity to attend an estate planning meeting with our clients…

Did you receive a CP14 Notice from the IRS? If so, you are not alone, and it is likely not a scam. The IRS recently…

Complexity in construction accounting abounds due to unique requirements, processes, documents, and procedures. Projects often rely on various funding sources to cover expenses such as…

The Inflation Reduction Act of 2022 is studded with opportunities to reap federal tax credit benefits. Two of those credits, the Residential Clean Energy Credit…

The United States has a retirement problem. Only 55 percent of employees participate in workplace retirement programs, setting themselves up for potential financial insecurity later in life….

As anticipated, Californians who have been impacted by severe winter storms that resulted in declared disasters will have extra time to get back on their…

Our tax team is again delivering news of a new tax deadline extension in the wake of recent disasters. On February 24, 2023, the IRS extended…

Over the past several years, cryptocurrency — also known as virtual currency — has gone from a fringe investing strategy and questionably nefarious trading method…

The past few years have brought many epic changes to our country and our firm — and yet, as I look forward to 2023, I…

While many Californians and area farmers have been relieved to receive substantial rainfall, we are now faced with the aftermath of receiving it in mass….

Retirement savings plans are undergoing significant changes to ensure that more Americans can save for retirement and increase the amount they can save. Our Tax…

As we approach year-end, our Client Accounting Services team is pleased to provide you with important information to assist you in making necessary changes for…

Once again, it is time to provide information for the timely filing of 1099 forms. Our revised 1099 information collection spreadsheet can be downloaded here….

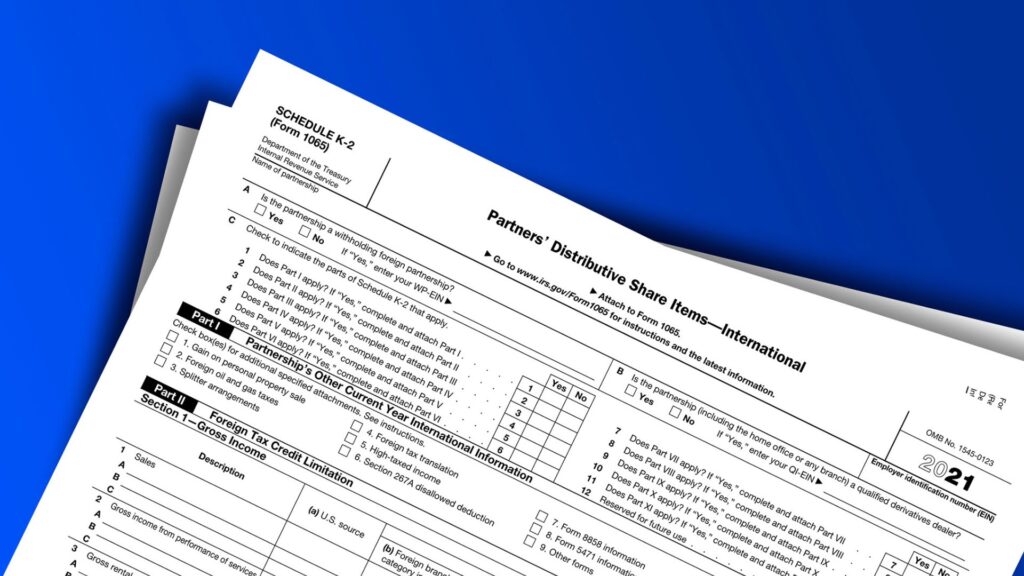

On November 28, 2022, we sent an article on IRS Schedule K-2 and K-3 Estate and Trusts Reporting Instructions and Requirements. However, changes within the latest…

You’ve heard the old axiom, “cash is king.” In an economic slowdown verging on recession, such as we’re facing now, it’s time to update that…

Last year we notified you of some new tax return forms affecting partnerships, LLCs, and S Corporations — the K-2 and K-3 Estate and Trusts….

As inflation continues to be well above the target pace of 2Estate and Trusts% set by the Federal Reserve, no doubt you have been wondering…

Technology and automation breakthroughs in recent years have made it easier than ever before to streamline business accounting practices. Our Client Accounting Services (CAS) team…

It’s year-end once again, and we are repeating a common thought: proactive tax planning ahead of time is the key to managing cash flows and…

Since 2003, the U.S. Department of Homeland Security and the National Cyber Security Alliance have been putting their focus on Cybersecurity awareness during the month…

October 17 – 23, 2022, is a favorite time of the year for our Estates and Trust team — it’s National Estate Planning Awareness Week….

Keeping businesses informed of essential tax updates to significant laws and available grants is a priority at GC. On September 29, 2022, Governor Gavin Newsom…

To simplify our quarterly payroll, sales, and mill tax form delivery process, Grimbleby Coleman will be implementing Suralink effective October 1, 2022. Suralink is an…

Completing a Transition, One Step at a Time GC Niche: Estates and Trusts GC Team Members Involved: Stephen Wray, CPA, and Ian Grimbleby, CPA Type…

A new development on the economic relief front was recently announced by the Internal Revenue Service (IRS). On August 24, 2022, the IRS announced IRS Notice…

On August 16, 2022, President Joe Biden signed the much-anticipated Inflation Reduction Act (IRA), essentially a curtailed version of the Build Back Better Act. The…

This past May, GC sent out information on the Passthrough Entity (PTE) Tax Election. We are now bringing you an important update regarding the 2022…

California Governor Gavin Newsom and legislative leaders have reached a 2022–2023 budget agreement that contains tax refunds to combat inflation as well as other major…

Simplifying an Estate Plan for a Smoother Transition GC Niche: Estates and Trusts GC Team Members Involved: Jamee Bollinger, CPA Type of Industry: Food Production…

Dear Clients, To give you ample time and notice to submit important documents, we are sharing this helpful tool to help ensure that your required…

Martin Fox, CPA/ABV, CVA

When I interviewed for a position at Grimbleby Coleman 19 years ago, I knew this wasn’t an ordinary firm. Our then-CEO, Clive Grimbleby, had a…

It has already been a long year for growers. Water woes, supply chain slowdowns, and rising inflation have combined to create an epic storm of…

We are bringing you an update on California’s Assembly Bill 150 (AB 150), enacted in 2021 as a method for deducting state and local taxes…

In the construction world, very little gets done without bonding agencies. Such agencies protect contractors and their customers against disruptions or financial loss. Construction projects…

If you’ve worked with Grimbleby Coleman before, you know our concept is a little different than most CPA firms. We attribute that to our advisory…

Martin Fox, CPA/ABV, CVA

It seems like you can’t go a day without hearing about supply-chain disruptions, inflation, or labor shortages. These three issues are having profound impacts on…

The California State Legislature has proposed a bill that would fix the passthrough entity elective tax and provide additional economic relief, if it passes. The…

In the blink of an eye, we’re switching out our calendars and planning for a whole new year! This past year, our firm went through…

The year is coming to an end. Read below for 2022 payroll and 1099 information. Also enclosed is a summary quick reference guide. Deadline for…

We’ve all experienced the innumerable ways the pandemic has upended the way we work and conduct business. In accounting, that change is especially evident in…

The end of the year is in sight, and as 2021 wraps with legislation still under construction, tax planning knowledge for yourself and your business…

On November 6, 2021, the $1+ trillion Infrastructure Investment and Jobs Act, H.R. 3684, passed through the House and Senate. On November 15, President Biden…

Grimbleby Coleman Accountants & Advisors

November 15, 2021 Few businesses are continuously profitable year after year. In fact, according to the publication Small Business Trends, only 40 percent of small…

As part of California’s Assembly Bill (AB) 150, the Main Street Small Business Tax Credit II is a follow-up from Senate Bill 1447 from 2020,…

Out of the plethora of retirement planning options available to U.S. workers — 401(k)s, 403(b)s, traditional IRAs — the Roth IRA stands out as the…

Grimbleby Coleman Advisors & Accountants

On July 16, Governor Gavin Newsom signed California Assembly Bill 150 into law. AB-150 contains tax relief measures that allow certain passthrough entities to pay…

QuickBooks Online is one of the most comprehensive accounting software packages on the market, and it’s a great tool to keep your business running as…

At Grimbleby Coleman CPAs, we work with clients to achieve superior financial and operational results, but one of the major roadblocks to success we’ve seen…

Grimbleby Coleman CPAs, Inc. is pleased to announce our merger with local accounting firm, Ristau & Co., Inc. CPA’s! This merger strengthens Grimbleby Coleman CPA’s…

For many agriculture businesses, fixed assets represent the largest account on the balance sheet. Fixed assets are any physical items that are acquired by a…

If you are one of the millions of Americans who will receive the Advanced Child Tax Credit in a few weeks, you should also be…

Even if you think you have years to spare, it’s important to start planning for retirement now. What would you like your money to do…

As a business owner, you likely know how crucial it is to maintain a handle on your company’s finances. Like many multi-tasking owners, however, you…

Governor Gavin Newsom has signed Assembly Bill 80, to amend the law. This will bring conformity to the federal treatment of PPP loan forgiveness and…

What Are Fixed Assets? When accountants use the term “fixed asset,” they are referring to a physical asset that is acquired by a company and…

Martin Fox, CPA/ABV, CVA

WOW! There’s a lot to talk about in this week’s e-blast. We’ll start with the highlights, but for those of you who want the details,…

The decision to sell or purchase a business is a complex one that requires careful assessment of financial, operational, and other key variables. The equation…

Martin Fox, CPA/ABV, CVA

What Changed? On March 3, the SBA announced a major change to PPP loans for self-employed individuals who file a Schedule C. They can now…

Title: Ag Case Study: An Embedded Approach to a CFO Vacancy GC Niche: Ag GC Team Member(s) Involved: Jeff Bowman, Clive Grimbleby Type Of Industry:…

Tax refund fraud is a concern now, more than ever, with the onset of COVID and scammers working full-time. Often, victims become aware of fraud…

The 2020 tax preparation season is here! To accommodate the changes we have all experienced over the last year, some adjustments have been made to…

Martin Fox, CPA/ABV, CVA

If your business cash flow needs a boost to get you through the COVID-19 crisis, take another look at the Paycheck Protection Plan (PPP) loans….

The Employee Retention Tax Credit (ERC) is designed to help businesses affected by the Coronavirus Pandemic and provides a refundable payroll tax credit to companies…

Happy New Year, friends! I hope you enjoyed the holidays and that 2020 closed out on a high note. As you likely know (and hopefully…

Martin Fox, CPA/ABV, CVA

December 21, 2020 Santa came to town early today for many small businesses. Congress finally agreed to a COVID-relief bill that will put some much-needed…

December 22, 2020 To say this year has been out of the norm would, of course, be an understatement. This year has been filled with…

December 29, 2020 The year is coming to an end, and we want to provide information regarding changes for 2021. Also enclosed is a summary…

December 30, 2020 Much attention is currently focused on the federal stimulus bill that was enacted on December 27th and its provisions to activate another round…

Martin Fox, CPA/ABV, CVA

November 30, 2020 We have recently become aware of clients receiving solicitation emails about their PPP loans. Some business owners presumed these were official notices…

Martin Fox, CPA/ABV, CVA

November 19, 2020 The IRS issued a highly anticipated (and much needed) ruling today regarding the tax treatment of PPP loan forgiveness and the related…

November 17, 2020 Ag has been a key part of our practice from the very start — 47 years and “ac-counting”. We know ag because…

Grimbleby Coleman Advisors & Accountants

November 17, 2020 Construction is one of the most labor-intensive industries out there — and we’re not just talking about the hard work of building….

November 3, 2020 Much has changed throughout this year. As 2020 comes to a close, you can be sure of one constant: future tax filings…

October 21, 2020 On October 1, the Department of Health and Human Services (HHS) provided guidance for health care providers who have already received relief…

October 20, 2020 This week, (October 19 – October 25, 2020) is National Estate Planning Awareness Week. In the accounting world, it’s a week dedicated…

Martin Fox, CPA/ABV, CVA

October 9, 2020 Yesterday, the SBA released a new simple one-page loan forgiveness application (Form 3508S) for PPP borrowers with loans of $50,000 or less….

Martin Fox, CPA/ABV, CVA

September 2, 2020 We understand that many banks are beginning to contact PPP borrowers regarding their loan forgiveness applications. Some banks are encouraging borrowers to…

September 11, 2020 On September 8, 2020, an executive order was signed by President Trump to defer the withholding, deposit, and payment of certain payroll…

Martin Fox, CPA/ABV, CVA

September 10, 2020 We live in a world of scoreboard watchers. Go to any sporting event, and you’ll see massive scoreboards displaying all sorts of…

Martin Fox, CPA/ABV, CVA

September 10, 2020 We live in a world of scoreboard watchers. Go to any sporting event, and you’ll see massive scoreboards displaying all sorts of…

August 10, 2020 A short time ago, many of us would not have thought that our lives would essentially come to a screeching halt due…

Martin Fox, CPA/ABV, CVA

July 27, 2020 If you’re like most PPP borrowers, you’re anxious to apply for loan forgiveness with your bank. Here’s what we’ve heard from some…

Martin Fox, CPA/ABV, CVA

June 18, 2020 On Tuesday, June 16, the SBA released two new versions of the PPP Loan Forgiveness Applications, including an EZ version for certain…

Martin Fox, CPA/ABV, CVA

July 6, 2020 While all good things must come to an end, the Paycheck Protection Program (PPP) was just given a new life. On July…

July 13, 2020 Recently the U.S. Supreme Court agreed to hear a case addressing the constitutionality of some items in the Affordable Care Act (ACA)….

June 12, 2020 Many of our clients are small and medium-sized California businesses, which means they are now required to provide their employees with access…

Martin Fox, CPA/ABV, CVA

May 26, 2020 Now that many of the Paycheck Protection Program (PPP) loans are about half-way through their eight-week loan forgiveness period, many borrowers have…

May 21, 2020 The US Department of Agriculture (USDA) recently announced more information on new direct payments to eligible farmers and ranchers through the Coronavirus…

Martin Fox, CPA/ABV, CVA

May 13, 2020 Over the past week or so, you may have heard various reports that the SBA was going to be reviewing PPP loans…

Martin Fox, CPA/ABV, CVA

May 5, 2020 Note: Please note that the following information reflects our understanding of the Treasury Department guidelines as of today, May 5th. Treasury continues…

Martin Fox, CPA/ABV, CVA

April 10, 2020 In one of our recent emails, we outlined various ways you can access cash for your business during these turbulent times. Starting…

April 6, 2020 The United States Department of Labor (DOL) has recently released the FFCRA which requires certain employers to provide paid sick leave and…

Martin Fox, CPA/ABV, CVA

May 6, 2020 We’re seeing an emerging trend in which many business owners are moving out of their ag businesses and passing control to their…

April 6, 2020 Real estate markets are hot in cities across the United States. Many people are eager to take advantage of these conditions but…

April 3, 2020 If you haven’t already heard, the IRS has released a revised W-4 that looks and feels much different than before. While the…

Martin Fox, CPA/ABV, CVA

April 1, 2020 We are in the throes of a crisis like none we have ever seen before. As people are hunkered down in their…

Martin Fox, CPA/ABV, CVA

March 4, 2020 How Much Is Enough? Break-even and Profit Analysis Do you know what your break-even point is? Your break-even point represents the number…

March 4, 2020 How to Leverage Your Real Estate Portfolio Without Forgetting Taxes If you’re a typical real estate investor (asset rich, cash poor) trying…

March 16, 2020 Dear friends and clients, Thank you for putting your trust in us to provide your tax and advisory services. These are rare…

March 19, 2020 U.S. Treasury Secretary Mnuchin announced on Tuesday, March 17, that there will be a 90-day extension for federal income tax payments due…

March 23, 2020 First of all, we hope this message finds you and your family in good health and spirits. We know how troubling and…

February 7, 2020 Avoid Individual Tax Penalties “Are you on track to meet your tax deadlines?” That question is one of the first things we…

The year is coming to an end, and we want to provide information regarding changes for 2020. You may also use this summary quick reference…

January 2, 2020 The 2019 tax preparation season is here! We wanted to make you aware of some important changes. Like last year, we will…

January 8, 2020 In March 2019, we released the article How to Seize the Opportunity of Opportunity Zones. In it, we outlined the exciting opportunities…

Accounting standards are continuing to change, and an upcoming change to lease accounting is a big one that lessees and lessors will definitely want to…