Grant Applications Open To California Small Businesses For New COVID Relief – Apply Soon!

December 30, 2020

Much attention is currently focused on the federal stimulus bill that was enacted on December 27th and its provisions to activate another round of PPP (Paycheck Protection Program) lending. We likely won’t know many details about the new program until sometime next week. Look for more information from our team when that happens.

Until then, California has launched a very different and much simpler business grant program for COVID-impacted businesses located in California. Governor Newsom announced the creation of the “California Small Business COVD-19 Relief Grant Program,” which makes available $500 million in COVID relief through grants for small businesses impacted by COVID and the health and safety restrictions. Upon approval, funds will be awarded in amounts up to $25,000 to underserved micro and small businesses throughout the state by early 2021.

The grant, funded by the State of California, is being administered by an experienced online lender, Lendistry. The application and qualification process will be very straightforward. The program will deliver grants ranging from $5,000 to $25,000 for businesses with annual revenues between $1,000 and $2.5 million. California businesses, including sole proprietors, home-based businesses, independent contractors, and nonprofits can qualify for this grant.

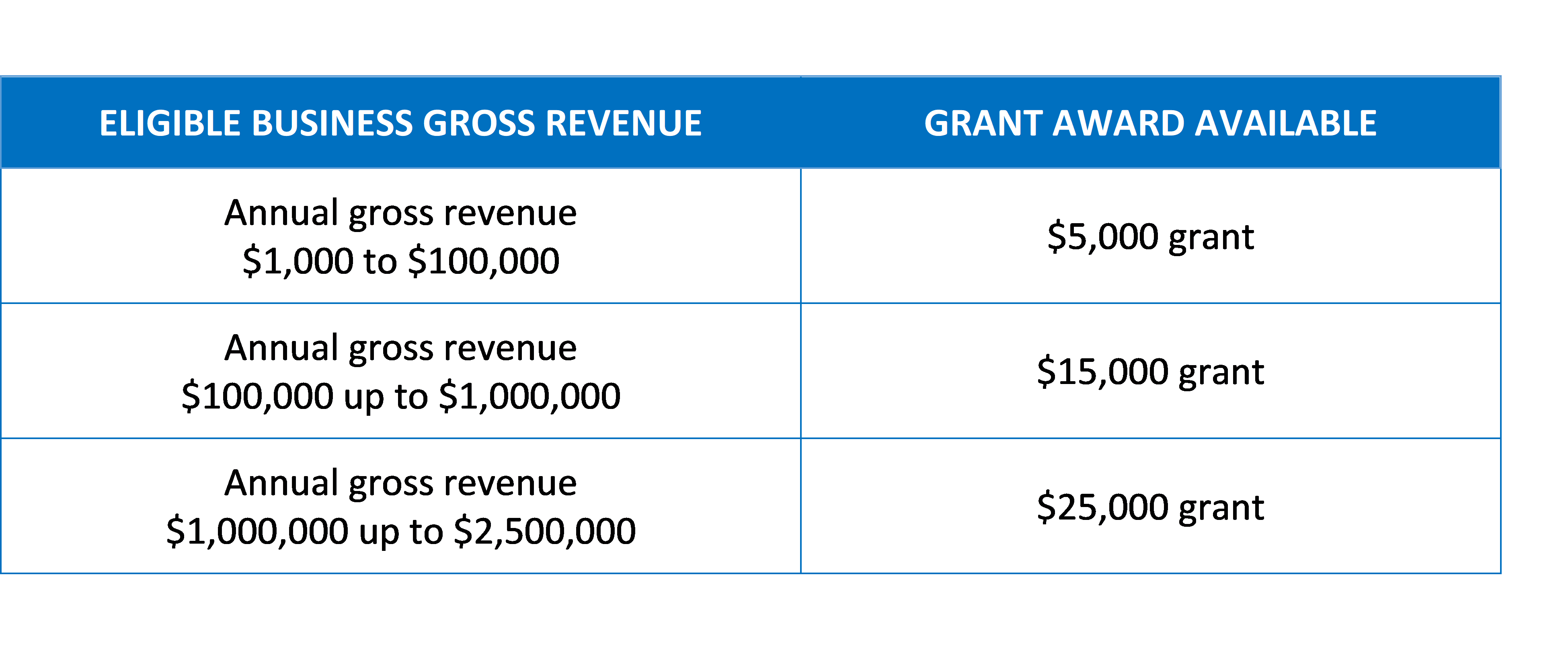

Awards range from $5,000 to $25,000 based on your operation’s annual gross revenue as reported in your most recent (2019 or 2018) federal tax return, as follows:

For those who qualify, the award is a grant, not a loan that has to be forgiven. The grant funds are to be used for working capital for your business’ operating expenses – e.g., for payroll, rent, business loan payments, COVID-protective measures, etc.

The California grant opportunity will be offered in two “Rounds” – with the first Round running from December 30, 2020, at 8 am to January 8, 2021, at 11:59 pm. All who apply during a Round will be given equal consideration. It is important to apply completely during the time the Round is open; the order in which applications are submitted is not relevant. Awards will be announced shortly after the Round closes, around January 13, and the second (final) Round is likely to be some time in February.

If you apply in Round 1 and are not successful, your application will be carried over for consideration in Round 2 without the need to reapply. If you are an owner of multiple businesses, franchises, locations, etc., you will be considered for only one grant across the two rounds and are required to apply for the business with the highest revenue.

We urge you to file as soon as possible before the Round 1 deadline, January 8, 2021. For your application, you will need to gather the following documents:

- Government Issued Photo Id/ Latest filed tax returns – 2018 or 2019 and a copy of official filing with the California Secretary of State, if applicable or,

- Local municipality for the business such as one of the following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration or Government-Issued Business License.

Our team is here to help. If you need additional clarification about your eligibility or this article, please contact Nate Miller, CPA (nmiller@gccpas.net). You can count on us to deliver updates on the second round of funding and other COVID relief news as soon as it is available.

For specific information about this CA Relief Grant, you can also visit the California SBDC’s program site.