Tax Refunds and Relief in the 2022 CA Budget Deal

California Governor Gavin Newsom and legislative leaders have reached a 2022–2023 budget agreement that contains tax refunds to combat inflation as well as other major tax relief measures. These measures are contained in various budget trailer bills that will be voted on by the California General Assembly shortly. Here are some highlights of these provisions and actions to look out for.

California inflation relief check

Governor Newsome signed the state budget on June 30, 2022, to send inflation relief checks of up to $1,050 to most California households.

Refund Thresholds

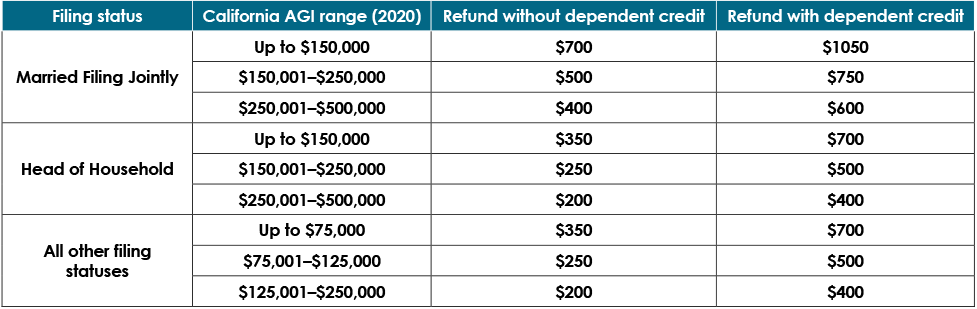

The chart below details thresholds for the proposed targeted tax relief checks based on income, dependents, and tax filing status.

- Single filers making less than $75,000 a year will receive $350, while joint filers making less than $150,000 will receive $700. For those with at least one dependent, they will receive an additional $350.

- Single filers making between $75,001 and $125,000 will receive $250, while joint filers making between $150,001 and $250,000 will make $500. For those with at least one dependent, they will receive an additional $250.

- Single filers making between $125,001 and $250,000 will receive $200, while joint filers making between $250,001 and $500,000 will receive $400. For those with at least one dependent, they will receive an additional $200.

Qualifying requirements:

- Be a California resident on the date the payment is issued and for at least six months during the 2020 calendar year;

- Have filed their 2020 tax return by October 15, 2021; and

- Not be claimed as a dependent on another taxpayer’s 2020 California tax return.

Other relief actions that may affect you

We look out for our clients and their businesses when it comes to tax relief. The following legislative actions could potentially impact your business.

- Extending the partial conformity to the federal treatment of Paycheck Protection Program loan forgiveness to apply to PPP loans approved after March 2021.

- AB 80’s 25% gross receipts reduction threshold would still apply to deduct expenses paid with these forgiven loans.

- Enacting first-time penalty abatement beginning on or after January 1, 2022. Unlike the federal first-time tax abatement, penalty abatement would only be available once in a lifetime rather than once every four years.

- Enacting a partial sales and use tax exemption for diesel fuel for the period October 1, 2022, through October 1, 2023;

- Allowing the 2020 and 2021 Main Street Small Business Tax Credits to be claimed on an amended tax return; and

- Extending the California Competes Tax Credit by five years through the 2027–2028 fiscal year.

Relief check payments are expected to begin going out to individuals by the end of October 2022 and conclude by the middle of January 2023.

Get in touch

Additional information about this tax relief is available by visiting the California Franchise Tax Board’s site on the Middle-Class Tax Refund. As always, we will keep you informed of any important changes and we are always happy to be a resource to you. Email us at contactus@gccpas.net or contact Ryan Root, CPA at rroot@gccpas.net for specific questions regarding these tax relief measures.